Business

Renegotiating Your Electricity Plan – When and How to Review Your Options

Published

7 months agoon

When an electricity contract ends, you must be ready to renegotiate with providers. This requires keeping track of your current contract’s expiration date and understanding your options.

Long-term contracts provide stability and predictability in energy pricing. However, they may restrict your ability to take advantage of market price declines.

Check Your Contract

It is essential to keep an eye on your contract expiration date. This will help you avoid paying an early termination fee if you change providers before your contract ends. In most cases, your provider will notify you that your contract is about to expire. This will give you enough time to choose a new plan or switch to a month-to-month option.

Listing the features you want in an energy plan is also essential. This will help you compare plans and find the best electric company in Abilene, TX, for your needs. You can consider renewable energy options, customer service, pricing, and more. It is also a good idea to look at your past energy use history to learn from it when choosing a plan.

Another important consideration is whether you should opt for a long-term or short-term electricity contract. Both have their pros and cons, and it all depends on your particular situation and energy consumption patterns. For example, a short-term contract might be cheaper but can leave you vulnerable to power price spikes. On the other hand, a long-term contract can save you money on your monthly bills and offer protection against rising rates. But if you opt for a long-term contract, you might have to pay an early termination fee if you decide to switch suppliers before your contract ends.

Review Your Options

Many energy providers are vying to get your business in states with deregulated electricity markets. Take the time to identify these competitors and gather important information about their rates, perks, and promotions. For example, are they offering lower introductory rates, rebates, or extra services? Evaluate your energy usage patterns to see if you benefit from a plan that offers competitive discounts during off-peak periods of the day.

It is also essential to carefully read the electricity facts label (EFL) or terms of service for any plans you are considering. This will provide essential details such as the price per kilowatt-hour, contract length, and usage tiers. It will also highlight any potential additional fees or charges that may surprise you.

Another thing to consider is whether you want a fixed-rate or variable-rate plan. Fixed-rate plans lock in a set rate for the duration of your contract, protecting you from fluctuations in the energy market. However, the price of energy fluctuates based on demand, which means you could pay more if you use a lot of energy during peak hours. On the other hand, variable-rate plans are more flexible and allow you to pay less if demand is low.

Negotiate

You will most successfully negotiate an electricity deal when you are fully prepared and confident in your request. Start by understanding the terms of your current contract and knowing what is available from other providers in your area. Identify your goals, be bold, and walk away if the offer does not meet your expectations.

Compare rates, contract lengths, hidden fees, and green energy options. Once you know what is available, call each supplier and ask for lower prices or more discounts on their plans. You may be surprised at how willing some companies are to negotiate.

The difference in electricity prices between providers is often more minor than you might think. The most significant chunk of the bill is usually the location-based marginal price (LBMB), which covers the cost of transporting electricity from where it was produced to your home or business. The LBMB is typically a fixed rate times your usage for the billing period.

The other significant factor is the time of use rate. You can enjoy significant savings if you shift your consumption to off-peak periods. In a deregulated market, you can negotiate your electricity rate by shopping around and using competitor rates as leverage. Be sure to research customer satisfaction ratings and provider track records as well.

Get a Quote

You can choose a different electricity and natural gas supplier if you are in a state with deregulated energy markets. It is essential to know what your options are so you can effectively negotiate your rates. This is especially important because the most significant chunk of your utility bill is the supply portion (Location Marginal Price, or LBMB), and you can control this with a new contract.

Start by researching the rates available from your current provider and their competitors. Companies may offer lower introductory rates, rebates, extra services, or other incentives to woo customers. Make a list of the details you have found so you can compare rates and decide what is best for your business.

Next, determine the length of your desired plan term. Some suppliers will offer a fixed rate for 6 or 12 months, while others may offer year-long contracts. It is essential to consider how long you want to be tied into a contract because breaking it early could result in an early termination fee or ETF.

Finally, determine if you would like to support green energy options. If so, look for a supplier that offers 100% renewable plans from solar or wind energy. It is also a good idea to review where the electricity will come from to ensure that it is produced in an environmentally responsible manner.

You may like

-

Smart Layering: A Guide to Efficient Outdoor Clothing Management

-

North South Tech: Your Premier Choice for Web Development and Management Software Solution

-

Pets and plants in long distance moving

-

Exploring the Advantages of PVC Commercial Roofing

-

The Growing Demand for Greensboro IT Support: Navigating the Future of Technology Services

-

Choosing the Best Size for Your Powder Coating Booths

Business

Smart Layering: A Guide to Efficient Outdoor Clothing Management

Published

1 week agoon

July 16, 2024

Key Takeaways:

- Understanding the fundamentals of layering for outdoor activities.

- How to select the appropriate materials and garments for various weather conditions.

- Tips for keeping your outdoor wardrobe versatile and functional.

Table of Contents:

- Why Your Choice of Material Matters

- Layering Basics

- Core Layers Explained

- Selecting the Right Insulation Layer

- The Importance of a Protective Outer Layer

- Accessorize Wisely: Enhancing Layering with Accessories

- Layering According to the Weather

- Maintenance Tips for Layering Pieces

- Sustainable Options in Outdoor Clothing

- Real-Life Case Studies

Why Your Choice of Material Matters

The selection of materials for each layer in a person’s outdoor wardrobe has critical implications for overall comfort and the functionality of the attire. Fabric properties vary widely, impacting their breathability, weight, moisture-wicking, and insulation efficacy. For instance, natural materials like merino wool are renowned for their ability to thermoregulate, offering warmth without overheating and cooling without chilling. At the same time, synthetic blends are prized for their resilience and quick moisture transport capabilities, ensuring a wearer’s skin remains dry and less prone to chilling post-exertion.

Layering Basics

We embark on an outdoor adventure, whether a leisurely hike or a rigorous mountaineering expedition, starting with a foundational understanding of effective layering. It is a strategic approach to clothing that involves selecting, combining, and utilizing different layers of garments to create a functional and adaptable attire system that responds favorably to weather conditions, activity levels, and personal comfort. One of the critical elements in successful layering is choosing a reliable base layer, found at retailers specializing in outdoor gear, such as Columbia Sportswear, who offer a diverse assortment of options designed for different climates and activities.

The essence of layering revolves around air trapping and moisture management. Utilizing air as an insulator between layers and ensuring timely moisture transportation away from the skin helps maintain a dry and temperate microclimate central to comfort and warmth outdoors. This necessitates a balance between insulation and ventilation; the layers selected must work in tandem to contain body heat while permitting sweat evaporation, thus sidestepping issues caused by damp garments, which can lead to rapid heat loss and potential hypothermia.

For those seeking a thorough dive into the science of effective layering, resources such as Outside Online offer in-depth examinations and expert insights into the nuance and strategies behind each layering decision tailored to specific outdoor situations.

The Science of Moisture Management

At the core of any layering approach is choosing materials for base layers that excel in moisture management, a quality paramount in maintaining comfort and avoiding hypothermal reactions when outdoors. Synthetic fibers such as polyester and nylon are particularly adept at wicking away moisture and facilitating quick drying. These materials close to the skin are imperative to minimizing the sensation of wetness and preventing the body from experiencing temperature drops post-activity. Brands devote significant research and development to optimize these fabrics’ technical properties, but it is imperative to follow care instructions to preserve these characteristics.

Core Layers Explained

The core layers are critical to the layering system as the initial defense against external temperature variations. Positioned closest to the skin after the base layer, core layers are tasked with managing moisture and providing an initial level of insulation. They are structured to be form-fitting, maximizing fabric-to-skin contact, which is central to efficient wicking. As with any component of stacking layers, these come in various weights and styles, allowing the wearer to adapt to their immediate environment and the activity level, from lightweight pieces suitable for mild climates to heavyweight options intended for chillier endeavors.

Selecting the Right Insulation Layer

As the name suggests, the insulation layer’s primary function is to retain body heat, and this layer generally occupies the middle spot in a layering lineup. Fleece jackets, down vests, and wool sweaters are standard selections due to their proficiency in providing warmth without the cumbersome bulk. Their design allows for trapping heat effectively while still facilitating freedom of movement, thus making them an ideal choice for outdoor adventurers. Choosing the suitable insulation layer depends on preference and practicality; size and compressibility matter if you pack and adjust layers throughout the day.

The Importance of a Protective Outer Layer

Bracing for what nature throws at you requires a competent outer layer. This layer acts as a fortress against rain, wind, and snow. A protective shell’s primary attributes are its resilience to weather and its breathability. Options range from soft shells, esteemed for their elasticity and breathability, favoring intense physical activity in moderate weather conditions, to hard shells that are paramount for protection in more severe, unpredictable climates. Contemporary design intelligently integrates adjustable features for venting and modifying how the garment sits on the body, ensuring that the wearer can regulate temperature effectively amid activities.

Accessorize Wisely: Enhancing Layering with Accessories

An intelligent selection of accessories can significantly boost the comfort and adaptability of your layering strategy. Small additions such as hats, gloves, scarves, or gaiters substantially impact retaining body warmth. The head, hands, and neck are areas where heat can quickly dissipate, and by addressing these zones, one can effectively modulate their body temperature. The beauty of such items lies in their ability to be easily added or removed in response to the body’s heat production or the rise and drop in external temperatures.

Layering According to the Weather

Weather awareness is indispensable to successful layering and overall readiness for the great outdoors. Sudden meteorological shifts, widespread in mountainous or coastal regions, necessitate a proactive and preemptive layering strategy. It’s recommended to consult accurate weather forecasts, such as those provided by The Weather Channel, and prepare accordingly, ideally bringing additional layers that can be easily donned or shed as conditions fluctuate. Staying ahead of the weather means greater comfort, safety, and enjoyment of outdoor pursuits.

Maintenance Tips for Layering Pieces

Each layer in your outdoor gear lineup requires specific maintenance to ensure longevity and peak performance. Diligent care practices, according to manufacturers’ guidelines, are vital. For example, technical fabrics often need a gentle wash cycle or hand washing to preserve technical properties such as waterproofing or breathability. Re-waterproofing with a DWR spray can also revitalize a garment’s weather resistance. Treating your outdoor apparel with care elongates its life and maintains its protective and insulative features, safeguarding against wear and tear.

Sustainable Options in Outdoor Clothing

The push for more environmentally responsible choices in all aspects of life extends to outdoor clothing. The industry’s response is seen in the emergence of products manufactured from recycled materials or through more ecologically considerate production processes. Brands that take definitive steps toward sustainability offer consumers the chance to make more meaningful purchase decisions that align with their environmental values. These sustainable garments often hold up longer than their conventional counterparts, reducing their environmental footprint over time.

Real-Life Case Studies

The real-world experiences of seasoned outdoor professionals and enthusiasts can be immensely educational for those looking to perfect their layering system. Detailed accounts of adventures undertaken in varying climates provide context to layering theory, spotlighting effective combinations and the versatility required to cope with the elements. Through such case studies, valuable lessons can be extracted and applied to one’s outdoor activities, improving preparedness and comfort during diverse adventures.

When it comes to selecting a reliable and efficient roofing solution for commercial buildings, PVC (Polyvinyl Chloride) roofing has established itself as a top contender. Known for its outstanding durability, energy efficiency, and versatility, PVC roofing is a popular choice among building owners and contractors. This article will delve into the composition, benefits, applications, unique features, installation tips, and maintenance advice for PVC commercial roofing.

Introduction to PVC Roofing

PVC roofing is a single-ply membrane roofing system composed of polyvinyl chloride and other additives that enhance its flexibility and performance. The material is known for its strength and resistance to various environmental factors, making it a reliable option for commercial roofing. PVC membranes are typically available in white, which provides excellent reflectivity and contributes to energy efficiency.

Key Benefits of PVC Roofing

PVC roofing offers numerous benefits that make it an attractive choice for commercial properties:

- Durability: PVC roofing membranes are highly durable and resistant to punctures, tears, and impact damage. They also exhibit excellent resistance to UV radiation, chemicals, and fire, ensuring long-lasting performance.

- Energy Efficiency: The reflective properties of PVC roofing help reduce heat absorption, leading to lower cooling costs and improved energy efficiency. This makes PVC roofing an eco-friendly option that can contribute to LEED credits.

- Low Maintenance: PVC roofing requires minimal maintenance due to its inherent resistance to dirt, debris, and biological growth. Regular inspections and cleaning are usually sufficient to keep the roof in optimal condition.

Applications and Suitability

PVC roofing is suitable for a wide range of commercial applications, including:

- Office Buildings: The energy efficiency and durability of PVC roofing make it ideal for office buildings, helping to reduce operational costs and provide a comfortable indoor environment.

- Retail Stores: PVC roofing’s reflective properties can help retail spaces lower their cooling expenses, creating a more pleasant shopping experience for customers.

- Manufacturing Facilities: The chemical resistance and durability of PVC roofing make it an excellent choice for manufacturing and industrial buildings where exposure to chemicals and heavy equipment is common.

Unique Features and Advancements

PVC roofing technology continues to evolve, offering enhanced features and benefits:

- Reinforced Membranes: Modern PVC roofing membranes are often reinforced with polyester or fiberglass, providing additional strength and dimensional stability.

- Heat-Welded Seams: PVC roofing seams are heat-welded, creating a strong, watertight bond that is resistant to leaks and other forms of water infiltration.

- Recyclability: PVC roofing is fully recyclable, making it an environmentally responsible choice that reduces waste and contributes to sustainability.

Installation Tips and Maintenance Advice

Proper installation and maintenance are crucial for maximizing the performance and lifespan of PVC roofing:

Installation Tips

- Surface Preparation: Ensure the roof deck is clean, dry, and free of debris before installing the PVC membrane.

- Proper Fastening: Use appropriate fastening methods and materials as specified by the manufacturer to secure the membrane and prevent uplift.

- Seam Welding: Utilize heat-welding techniques to create strong, watertight seams that prevent leaks and ensure the integrity of the roof.

Maintenance Advice

- Regular Inspections: Conduct routine inspections to identify and address any potential issues, such as punctures, tears, or loose seams.

- Cleaning: Keep the roof surface clean by removing debris and dirt regularly to prevent damage and maintain its reflective properties.

- Prompt Repairs: Address any damage or leaks promptly to prevent further deterioration and extend the life of the roof.

In conclusion, PVC commercial roofing offers a range of benefits that make it a top choice for various commercial buildings. Its durability, energy efficiency, and low maintenance requirements, combined with advancements in technology, ensure that PVC remains a leading option in the roofing industry. By following proper installation practices and maintenance routines, businesses can enjoy the long-lasting performance of their PVC roofs for many years to come.

Business

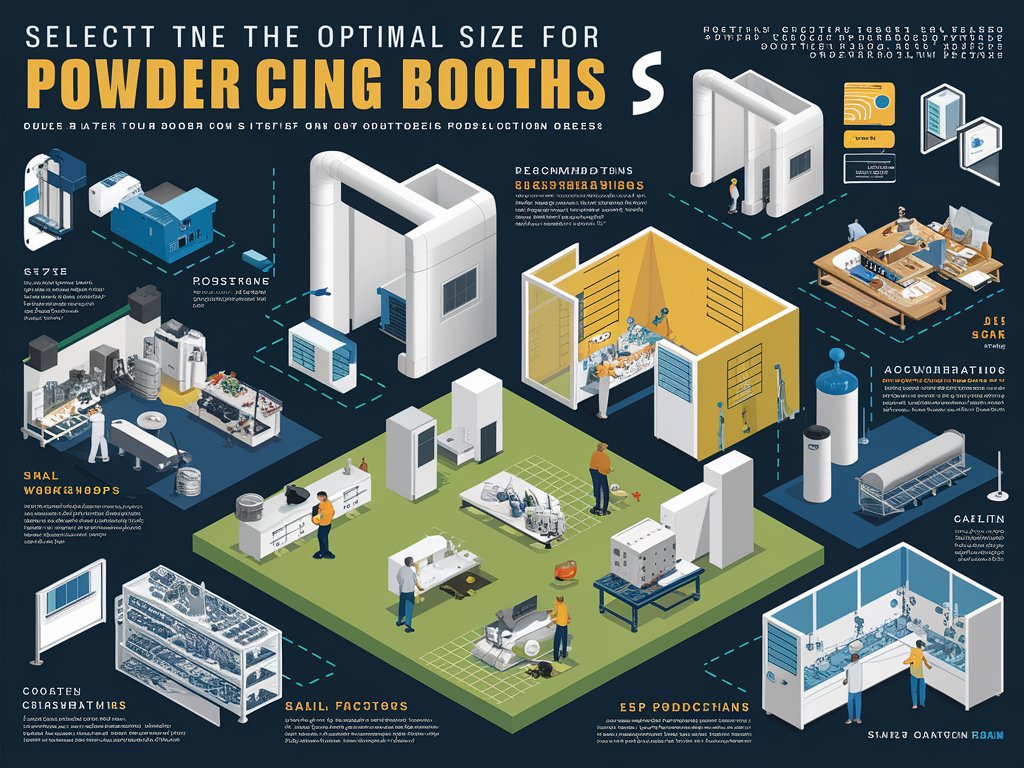

Choosing the Best Size for Your Powder Coating Booths

Published

2 months agoon

May 23, 2024

When it comes to optimizing your production facility, selecting the right size for your powder coating booths is a crucial decision that can significantly influence operational efficiency and cost-effectiveness.

This detailed guide will walk you through the key considerations to keep in mind while determining the ideal booth size for your specific needs. We’ll cover everything from assessing production requirements and available space to considering future scalability and consulting with industry experts. Let’s dive in and find the perfect fit for your facility.

Assessing Production Needs and Throughput Requirements

First and foremost, understanding your production demands is vital. How much volume do you expect to handle? Are your projects typically large or small? These questions are fundamental as they directly impact the size and type of powder coating booths required. For high-volume production environments, larger booths or multiple paint spray booths might be necessary to handle the workload efficiently without bottlenecks. Each project’s specifics, such as dimensions and turnaround time, must also be considered to maintain a smooth workflow.

Evaluating Available Space and Facility Constraints

Now, let’s talk about the space you have. Before you can decide on the size of your blast booths, you need to evaluate the physical area of your facility. Is space at a premium, or do you have room to grow? The layout of your facility will influence the type of booth you can accommodate—whether it’s a more compact, vertical setup or a sprawling, horizontal one. It’s essential to ensure that there’s enough room for not only the booth but also for safe and efficient operation around the booth area.

Considering Future Expansion and Scalability

Thinking ahead is key in business. As you look at the present requirements, it’s wise to also consider future growth. Will your production demands increase? If so, opting for scalable solutions in your powder coating booth setup can save you significant time and money down the line. This might mean choosing modular booths that can be expanded or reconfigured as your business grows and evolves.

Understanding Equipment Compatibility and Integration

Compatibility is another critical factor. Your new powder coating booth should seamlessly integrate with existing systems. This involves considering the technical specifications of the booth relative to your current machinery, such as conveyor belts or automated spray systems. Ensuring that all components of your production line communicate effectively with one another is essential for maintaining operational harmony and maximizing throughput.

Analyzing Budgetary Considerations and Cost Efficiency

Budgeting cannot be overlooked. While it’s tempting to go for the largest or most technologically advanced booth, it’s important to balance your needs with what you can afford. Cost-efficiency doesn’t just come from purchasing the booth but also from its long-term operation and maintenance costs. Consider energy consumption, filtration systems, and maintenance access when choosing your booth size and features, as these can significantly affect overall expenses.

Consulting with Manufacturers for Guidance

Lastly, don’t go at it alone. Consulting with manufacturers can provide invaluable insights into the latest technologies and trends in powder coating booths. These professionals can offer tailored advice based on your specific production needs, available space, and budget. Taking the time to discuss your options with experienced professionals can lead to better decision-making and a more optimized production environment.

By carefully considering these aspects, you can choose the best size for your powder coating booths that not only meets your current needs but also accommodates future growth. Remember, the right investment in your infrastructure is pivotal to enhancing your operational efficiency and ultimately, your bottom line.

Smart Layering: A Guide to Efficient Outdoor Clothing Management

North South Tech: Your Premier Choice for Web Development and Management Software Solution

Pets and plants in long distance moving

yt.be Activate: Activating YouTube with yt.be

Finance and Maneuver in Business